All About Digitally-Native, Vertical Brands (DNVBs)

Get to know how DNVBs are shaping the modern economy.

Learn how they sell, who they serve, and what makes them tick.

1. DNVBs are the Next Big Thing. They are growing nearly 3x as fast as the average e-commerce retailer. The top 75 DNVB retailers generated $8 billion total in 2017, which was 44 percent growth compared to the year before. Look out, world!

(source)

While it’s still incredibly early in the history of digital, vertically-integrated brands, many are beginning to turn entire industries on their heads. (source)

2. To qualify as a DNVB, you must sell online, directly to consumers (no third parties), and control your product all the way from warehouse to customers (no middlemen). Examples:

Harry's Inc (razors)

Blue Apron (meal kits)

Casper, Nectar (mattresses)

Rad Power Bikes (boosted bikes)

Proper Cloth (custom dress shirts)

Article (online furniture)

Brilliant Earth (diamonds)

Warby Parker

Casper

Everlane

Glossier

Harry's

Dollar Shave Club

Walker and Company

Alo Yoga

Allbirds

Bonobos

Soylent

The Honest Company

3. DNVBs win because of unit economics and branding.

4. Unit economics: Margins can be upwards of double that of e-commerce. E-commerce runs teeny, tiny margins. DNVBs have healthy margins. When you own the full supply chain (the "vertical (V)" of DNVB), you have more control over price and, therefore, margin.

"The product gross margins are at least double that of e-commerce (e.g. 65% versus 30%). The contribution margins can be 4–5x higher (e.g. 40–50% versus 10%). This radically transforms the economics of the vertical commerce compared to e-commerce. Vertical commerce can make money. E-commerce, not so much. (source)

5. Brand is the single biggest differentiator for DNVBs versus competitors. Branding is everything. Branding leads to customer loyalty. Branding extends throughout the customer experience. Branding improves the value of what's being sold. DNVBs thrive because their customers love the brand. Competitors thrive because customers love the price. Brand is forever, price is fleeting.

6. DNVBs are not e-commerce. In the Venn diagram of DNVB and e-commerce, yes the two circles overlap a little (some brands may be both), but fundamentally the two are different. There is a huge gap between the unit economics and brand experiences of DNVBs vs. e-commerce.

The e-commerce channel serves as an enablement layer for DNVBs, not the core asset.

(source)

7. DNVB marketers have incredible amounts of data at their fingertips. And they know how to use it! Data = better marketing. Better marketing = lower costs. Lower costs = higher margins. When you fully control the supply chain the way DNVBs do, you have the luxury of capturing customer data throughout the buying experience. This is a HUGE competitive advantage. DNVBs know what to do with this data (see "strategies" below).

8. To fully understand DNVBs, you must understand their fears. Fear #1: Amazon. How do you compete against the world's biggest store? Three ways: 1) Invest in your unique brand, 2) Develop a deep expertise of your product and your customers, and 3) Deliver a world-class, end-to-end experience.

Everything revolves around the customer. Yes, the product itself needs to be great, but so too does the whole experience: hearing about you from a friend, following you on social, seeing your ads, visiting your website, ordering a thing, opening a box, then loyalty, loyalty, loyalty.

The inherent promise of the DNVB model is to put back the consumer at the heart of the value proposition by offering a buying experience that is as memorable as the product.

(source)

9. Broken record alert! DNVBs care a LOT about branding and community. Brand is the stone that allows David to take on Goliath.

10. The core marketing strategies of DNVBs are:

Engage with customers on social media

Run targeted ads based on actionable data

Leverage micro-influencers and word-of-mouth

Virality (early-adopters, referrals, direct traffic)

Community building and brand identity, including pre-launch strategy

Strong focus on SEO

Alternative marketing channels include offline events, celebrity endorsements, pop-ups, etc.

11. DNVBs are masters at picking a category ripe for disruption and mastering that category's product and customer from A to Z.

Additional reading:

The book of DNVB

The article that started it all, written by Bonobos founder Andy Dunn

What is a DNVB? & The Rise of the DNVB

Solid overviews of what makes a DNVB a DNVB.

Why DNVBs will survive the rise of Amazon

The three factors that make the DNVB model defensible.

Digitally Native Resources for the Digitally Native Consumer Economy

Exhaustive and well-researched collection of DNVB articles and resources.

The direct-to-consumer landscape

Famous for its spreadsheet about D2C categories.

The subtle art of (not) understanding DNVBs

How to know which DNVBs are worth investing in.

Diagnosing Direct-to-Consumer Disruption

Discussion of the two main ways that D2C disrupts the incumbents.

How DNVBs grow: We Analyzed 9 Of The Biggest Direct-to-Consumer Success Stories To Figure Out The Secrets to Their Growth — Here’s What We Learned

Downloadable guide, discussing specific tactics that DNVBs use to grow their biz.

Mary Meeker Report E-commerce 2018

Data!

Glossier on my face to Allbirds on my feet — D2C from head to toe

Great explanation of how DNVB and e-commerce differ.

Direct-to-consumer marketing course @ Yotpo

All about the rise of D2C.

Keep scrolling for excerpts from some of these articles.

(If you happen to find another article you'd like to see on this list, please drop me an email. I'd love to hear from you.)

Cliff's Notes:

What is a DNVB?

by Digital Commerce 360 // April 2018

A digitally-native retailer first started selling online, taking advantage of lower overhead and easy access to consumers across the country to grow their business. Vertically integrated brands control the product from the factory floor to the consumer’s hand.

Retailers can grow beyond selling only online, moving into their own stores or working with individual retailers. Often these physical spaces serve like showrooms that shoppers often don’t walk out of with the product in hand.

Showroom example: Brilliant Earth

Many retailers don’t own the factories, but they do specify exact product details, making what they sell directly to consumers unique or even customizable. This allows retailers to control where and how their product is sold, and also allows them to collect data on who is buying the product to better market and improve their products.

DNVBs’ ability to create unique products and connect with niche audiences insulate them from some competition with Amazon.com Inc. (No. 1) and other big retailers. And the direct-to-consumer model keeps prices down as well, making their unique wears more affordable to the niche or mass-market audience they want to draw.

The Rise of the DNVB [HuffPo]

by Juliet Carnoy, Pixlee // Feb 2017

Jeff Jones, a managing partner at Andreessen Horowitz, refers to this as ‘e-commerce 2.0.’ However, the brands emerging in the retail sector that are seeing the greatest growth are quite different from their e-commerce predecessors.

Another name for these brands: v-commerce brands.

While v-commerce brands may ultimately expand offline through select partnerships or brick and mortar stores, they control their own distribution tightly.

Advantages of DNVBs

Direct sourcing of materials

Enhanced brand experience

Alternative distribution methods

Increased engagement on social media

Direct sourcing of materials

Digitally native vertical brands are collapsing inefficient legacy supply chains by cutting out intermediate layers... They facilitate a rapid feedback loop so that they can quickly iterate on product design and demand and use their relationships with factories to better market their materials and to instate price transparency for customers on the true cost of their products.

(example: Everlane)

Enhanced brand experience

The digital vertically integrated brand is Internet enabled, born digitally, and interacts with customers primarily online. It seeks to build a strong brand lifestyle that speaks to people and shapes their choices. To build such a community, v-commerce brands present and design their products in a highly compelling way and in a consistent voice.

DNVBs’ products meticulously represent the brand identity and both their products and their packaging are designed to be shared on social media. These brands rely heavily on visual content displayed across a multitude of marketing channels. To scale content creation and to meet content needs, DNVBs often rely on user-generated content.

(example: Glossier owes 90% of its revenue to its fans on Instagram)

"V-commerce brands place a high emphasis on real customer photos and videos."

Alternative distribution methods

For digitally-native vertical brands, the e-commerce channel serves as an enablement layer, not the core asset. By selling directly to consumers, these digitally native consumer packaged goods brands are not only able to control their own distribution but are also able to better control their brand stories and relay messages directly to customers. As a result, they collect massive amounts of customer data that allows them to test and develop new products.

Increased engagement on social media

These brands place importance on community-building through one-to-one marketing.

Through strong presences on today’s leading social platforms, v-commerce brands bring their customer service and content to the platforms on which their customer base is active.

They build digital experiences that customers can engage with and share their brand allegiance about. These experiences cater to Millennial and Gen Z customers in particular, who make up the majority of digitally native brands’ customer bases.

The book of DNVB [Medium]

by Andy Dunn, Bonobos // May 2016

Its primary means of interacting, transacting, and story-telling to consumers is via the web.

The name of the brand is on both the physical product and on the website. The DNVB requires the commercialization of an e-commerce channel, but that channel is an enablement layer — it’s not the core asset. VCs sometimes think these should be valued like technology companies. Some of the valuations still reflect this misguided notion. These are retailers, not tech companies. They cannot spend 10% of sales on technology and 30% of sales on marketing forever.

The profit-losing nature and small scale of the DNVBs leads most traditional retailers to ignore or underestimate these little tadpoles. Then Unilever bought Dollar Shave Club for $1 billion. Smart people woke up. The reality is the brand of the future is a DNVB, but the future is not here yet. It’s in the corner. Give it a couple decades to take over the room.

"The product gross margins are at least double that of e-commerce (e.g. 65% versus 30%). The contribution margins can be 4–5x higher (e.g. 40–50% versus 10%). This radically transforms the economics of the vertical commerce compared to e-commerce. Vertical commerce can make money. E-commerce, not so much. Bonobos is now a breakeven business. It took us a decade. I am not proud of that, it takes a fair amount of scale, a wonderful team, and lots of learnings along the way to turn the corner. “Pioneers get the arrows, settlers get the gold.” Turns out it takes ten years to build a brand."

The digitally-native vertical brand is maniacally focused on the customer experience.

"The difference between e-commerce and DNVB is profound, and it requires an appreciation the role brand plays in inspiring people, speaking to them, shaping their choices, and a sharp understanding of how different the economics and growth trajectories are."

Differences in the unit economics and the contribution margin cohorts are profound — apples to oranges.

"Brand matters. These brands have a soul that is not easy to quantify at first."

"The e-commerce company is a channel; the DNVB is a brand. The e-commerce company has low margins; the DNVB has high margins. The e-commerce company can grow unbelievably fast; the DNVB can’t grow as fast, but it’s more valuable in the long run because it’s about more than just price."

The direct-to-consumer landscape

by Teddy Citrin, VC @ Greycroft // June 2017

Legacy brands which have traditionally sold through third parties are realizing that they don’t know their customers and they are getting undercut by new entrants that can improve the value chain and customer experience by going direct.

Example: Crest sends toothpaste to Costco which sells Crest.

Example: LG sends TVs to Best Buy which sells LG.

Example: You go online to buy a Quip toothbrush from Quip. Quip gets all the data on your conversion experience.

The risk for big companies:

A few large incumbents dominate the market, which means pricing could be inflated and traditionally there may be little incentive to provide excellent customer service.

There hasn’t been much product innovation in the category in the last couple of decades which means building a strong brand is the most important objective.

A world class team and an authentic brand that resonates with consumers can take a seemingly uninteresting market by storm.

Spreadsheet: Market analysis

The subtle art of understanding DNVBs

by Cayetana Hurtado, VC at Balderton // Aug 2018

"DNVBs are a subcategory within e-commerce."

The main differences between DNVBs and traditional e-commerce businesses are:

DNVBs are brands that have end-to-end control over the production, marketing, and distribution processes or are fully vertically integrated.

They benefit from higher margins (c.2x gross margins and c.4x higher contribution margins vs traditional e-commerce companies) although they often have lower top-line growth rates.

DNVBs have a stronger focus on branding and community building; it’s all about the customer experience.

These companies are born and mainly operate online (they are digitally native!).

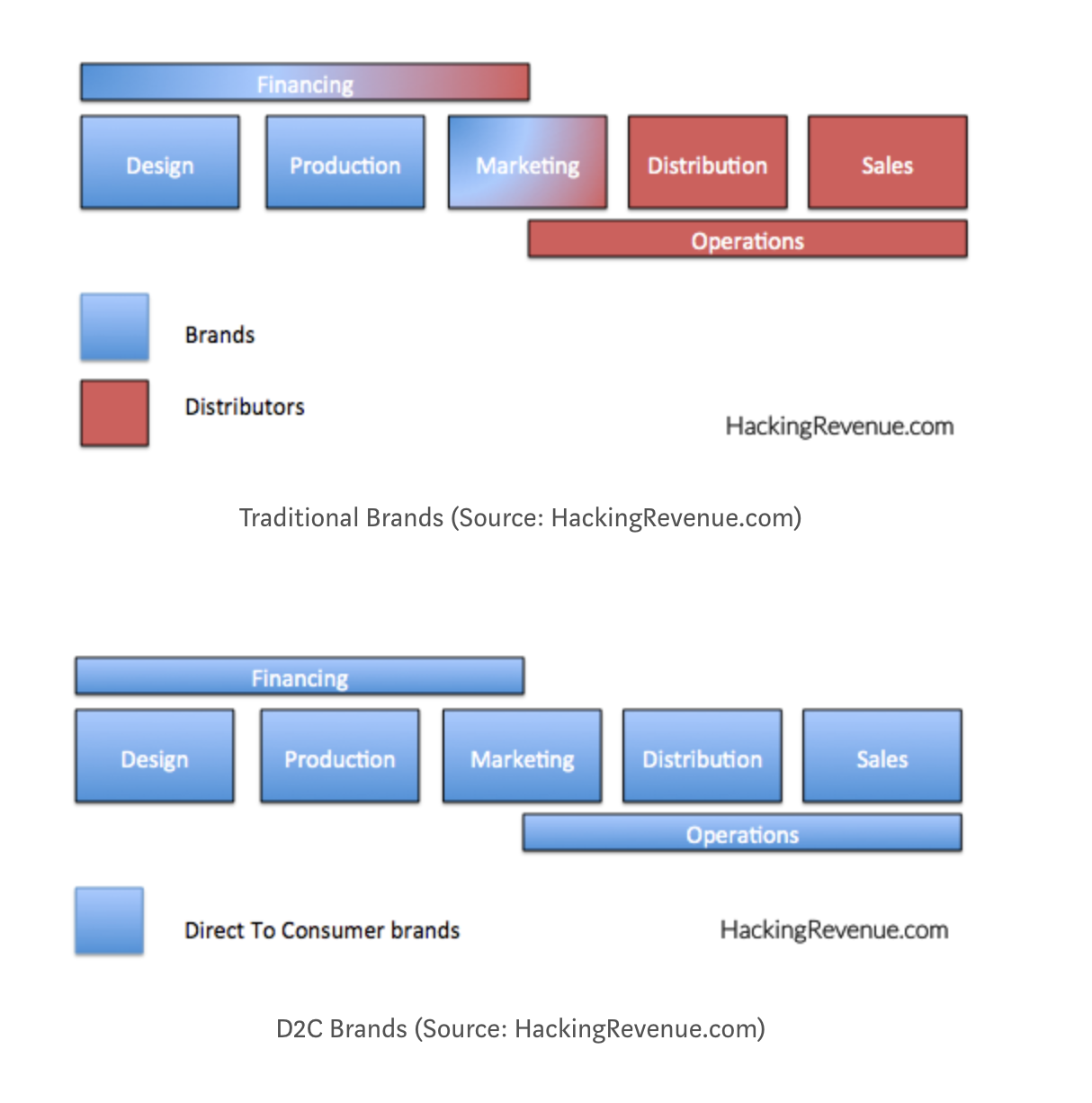

Difference between traditional brands (involving distributors) and direct-to-consumer brands (no distributors)

Most of the popular brands people use were born with our parents, not with us. Think of Nike, Topshop, or Estée Lauder; not to mention the older generation of Levi’s, Ray Ban, or Chanel.

I think DNVBs are the brands millennials and mainly Generation Z will end up being loyal to.

DNVBs should improve one or more of the following points:

Model of access, usually driven by distribution innovation (e.g. Casper, Dollar Shave Club, Harry’s).

Product innovation, what’s new or improved from a product standpoint(e.g. The Honest Company, Soylent, Simple Feast).

‘Democratization’ of a category i.e. better price-point / quality (e.g. Warby Parker, Everlane, Feed).

DNVBs have more targeted marketing thanks to data usage. This should lead to lower costs. DNVBs do most of their sales online, engage in social media with their customers, and have a better understanding of what users are looking for, helping reduce marketing costs by being more targeted and leveraging micro-influencers marketing.

A DNVB is, ultimately, a brand. Understanding the brand identity is key. What does the brand represent? Who are the target customers? What’s the vision? This determines everything, from the product through the packaging and distribution, to the marketing strategy. What does it mean to buy, own, use, or wear that brand?

When it comes to DNVBs, you should also consider habit formation and brand loyalty. For these businesses, branding can ultimately generate customer captivity, and create a ‘psychological switching cost’ for consumers. But branding alone is not enough. You need something else to build it, such as a better technology and know-how that leads to product innovation and / or better distribution and access, all with an outstanding user experience. Then, ‘flawless’ execution completes the secret sauce.

Success has been driven by one or more of the following strategies:

Product

Product innovation and high quality and / or lower price point

Design and manufacturing control

SKUs depth (or not!) and versions evolution

Marketing

Community building and brand identity, including pre-launch strategy

Virality (early-adopters, referrals, direct traffic)

Leverage data and targeted marketing, with strong focus on social media (including micro-influencers), SEO, and alternative marketing channels (offline events, celebrity endorsements, pop-ups, etc.)

Where we will focus: DNVBs

by Joyance Partners

Digitally Native Vertical Brands have these attributes:

1. Sold online primarily; bricks and mortar for marketing only

2. Can be micro-manufactured and shipped straightforwardly; preferably, but not always, using new tech materials or ingredients

3. Allow for a type of product design or economics not feasible in traditional channels (e.g., subscription boxes, customized products)

4. High customer lifetime value (LTV)

5. High margins on the product in part due to new materials, manufacturing and piggyback shipping

6. Propensity to be shared via social media or garner earned media

7. Timelessness of the product (products like household goods, personal care, and over-the-counter medications stay relatively consistent over time; fashion, by contrast, does not)

More: Categories to focus on in 2018 (best bets)

Why DNVBs will survive the rise of Amazon

by Camille Kriebitzsch, Principal at Eutopia VC // Jan 2018

Some predict that Amazon’s strategy to launch their own brands could threaten the DNVB model.

1. The power of the brand

DNVBs, just like Amazon, are trying to take advantage of the phenomenal growth of e-commerce. But the similarities stop here. Beyond this new distribution model, it’s a new generation of brands that is born advocating succinct values of transparency, authenticity, and services that consumers look for but can’t find in traditional offers. Thanks to the stories of the founders and with the help of original, viral content, these brands are able to engage with communities who will not only become loyal clients but also great ambassadors. In a time when consumers are more and more in search for meaning, short processes and real stories, the relevance of the DNVB model seems to be only at its inception.

2. The virtue of expertise

DNVBs position themselves as experts compared to their traditional, generalist counterparts. Integrated channels (Harry’s bought their own razor factory), unique models (like that of Casper), consulting mines (Glossier was founded by the blogger Emily Weiss): DNVBs choose a sector or even a product that they master from end to end.

3. An enhanced experience

The inherent promise of the DNVB model is to put back the consumer at the heart of the value proposition by offering a buying experience that is as memorable as the product. The consumer’s path is carefully crafted: the ergonomics and the content of the website have to be clear making it easy to understand and to find the most adapted product. Content is specialised and created by experts allowing for a more pertinent conversation with each visitor.

Mary Meeker Report E-commerce 2018

by Jason Buckland, content at Shopify // June 2018

Social media directly and indirectly drives sales.

By one poll of American shoppers, 55% said they had purchased a product online after discovering it through one social media outlet or another.

Chart from Mary Meeker's trends report

"Pura Vida Bracelets uses social media as perhaps the most vital arm of its multi-channel strategy. Through its micro-influencer referral program — which mixes social, onsite, and email — Pura Vida has learned how to:

Increase sales from referral reps by 300% year-over-year

Lift average order value 11% compared to non-referral orders

Lower customer acquisition costs by a factor of seven

How DNVBs grow: We Analyzed 9 Of The Biggest Direct-to-Consumer Success Stories To Figure Out The Secrets to Their Growth — Here’s What We Learned

by CB Insights // Dec 2017

Included in the report:

How DNVBs design their products: How to turn simplicity in a product line into luxury

How Casper sold $100M in mattresses by limiting choices

Why rolling back razor evolution got Harry’s 1M customers in two years

The simple, unadorned sneaker that helped Allbirds 4x their sales

How Bonobos turned one good pair of pants into a $310M business

How DNVBs launch their products: How to get mass mindshare quickly

Casper’s media-company strategy for redefining the mattress brand

How Harry’s signed up 100,000 people to a new razor’s email waiting list

The blog-first strategy that got Glossier 1.5 million potential customers at launch

Why The Honest Company’s Jessica Alba is the best kind of celebrity founder

How Soylent built a food replacement that sells like a SaaS product

How DNVBs build a better customer experience: How to build an end-to-end brand

Why Bonobos aims for (and hits) 90%+ “great” ratings on all their customer service emails

The 28,000+ subscriber community of obsessives that has fueled Soylent’s growth

Why Casper makes it $100-$200 cheaper to return their mattresses

The mechanic that drives Dollar Shave Club’s industry-best two-year 30%+ retention rate

Warby Parker’s plan to disrupt the $5 billion eye exam market

How Glossier’s skin tone matcher drives online conversions

How DNVBs go viral: How to bake ubiquity and virality into a physical product

Casper’s aggressive SEO strategy that drives 378,000 site visits a month

The strategy behind Dollar Shave Club’s million-view viral video

How one CTA drove 56,500+ user-generated videos that all linked back to Warby Parker

Glossier’s pool of 800,000 micro-influencers and how they drive 70% of the company’s growth

The single infographic that got Everlane 20,000 customers and helped them sell out of t-shirts

The Honest Company’s content marketing strategy that drives 151,000 visits from pre-qualified customers

Glossier on my face to Allbirds on my feet — D2C from head to toe

by Sitara Ramesh, Use Journal // Sept 2018

A majority of these brands focus heavily on online marketing, through channels like Instagram ads and influencer marketing.

Some brands have even created magazines of their own such as Here, a travel magazine by the D2C luggage brand Away. Likewise, Glossier was founded by Emily Weiss, the creator of the beauty blog Into the Gloss, which now acts as another channel to convert readers into customers. These tactics have created a multi-dimensional brand experience for customers, leading to highly-engaged customers and a devoted fanbase. Some of these super-fans go on to create user-generated content like Instagram posts, blogposts, YouTube videos, etc. featuring these products, leading to more organic buzz.

Because of the tightly integrated nature of online commerce tools, D2C brands have a more comprehensive overview of customer data, ranging from social media usage to website interactions. Although many traditional retailers are also able to access this type of data, D2C brands have access to newer tooling and more engaged customers, which enables them to tap into direct feedback from Instagram comments to YouTube reviews.

Digitally Native Resources for the Digitally Native Consumer Economy

by Deepka Rana, VC at SunStone // Aug 2018

Research Reports / Data

Loose Threads: Research and analysis on the changing consumer economy. The content comes in different forms, with special in-depth reports, industry playbooks, letters to brands/CEOs, as well as shorter, sub five-minute reads. Altogether, this forms an exceptionally well-rounded mix of content. ... The majority (and really good stuff) is only available via paid membership or purchasing an individual report.

CB Insights (CPG): Whole section of (free) research about the disruption of CPG. Find market maps for whatever vertical you want to explore and get a handle on who’s doing what, where, and how.

2PM: Membership provides access to a number of databases, including top retailers, DNVBs, independent publishers and agencies. Primarily covers US companies.

Stay Informed: Newsletters

Lean Luxe: LL highlights news and opinion pieces relevant to modern brands and consumer trends across the board. Each briefing packs in a lot of articles, but the format is tight, keeping it easy to skim and pick out whatever you’re interested in. It’s free and after a while you can request access to the accompanying Slack channel. An active community that includes founders, operators from brands, agencies, the media and investors.

2PM: The Monday brief delivers and summarizes the most interesting, if not always the most obvious, stories around eCommerce, DNVBs, Media and Retail. Paid membership provides access to additional briefings and access to their databases (see above).

Hear The Stories: Podcasts

Everyone loves a story. While it’s unlikely you’ll stumble across a red-hot trade secret, the anecdotes in the following interview-based podcasts are worthy of your ‘auto-pilot’ time (gym, commute, airport etc.). Familiar names include Glossy and Loose Threads. The 20 Minute VC has also run a couple of notable consumer-focused episodes, with both founders and investors. A few favorites: Forerunner’s Kirsten Green and Eurie Kim, Maveron’s Jason Stoffer, Hims founder Andrew Dudum, Glossier COO Henry Davis, Daily Harvest founder Rachel Drori. I’m sure there’s plenty more.

No I’m Not Procrastinating: Social Media

Ryan Caldbeck on Twitter: He’s the CEO of CircleUp, the funding platform for early-stage consumer brands, but also the author of a few very sharp tweetstorms. The first I came across, about the new opportunities in CPG, made waves. Ryan also offers thoughts on why incumbents are stuck, observations as an investor and CEO, data, board management and a host of other topics. Definite follow.

Thingtesting on Instagram: Do you enjoy aesthetically wonderful pictures, informative product reviews, and an investor perspective on the item and category? If any of those take your fancy, let Jenny’s account help you break up the usual stream of overpriced breakfasts and espresso martinis. Oh, and see if you can spot yours truly in the mix ✨

Diagnosing Direct-to-Consumer Disruption

by Sunny Dhillon, Founding Partner at Signia VC // Jun 2018

Supply-chain disruption

Brand disruption

"Brand disruption. This is when startups use internet platforms that revolve around content — such as social media and blogging — to create a more multidimensional brand experience that creates super-engaged customers and a devoted digital community."

Brand used to consist of packaging and whatever personality was conveyed through television and print ads. Those channels aside, there simply weren’t that many ways for the brand to express itself. With brand-expression channels like Instagram and blogging, a company like Glossier can publish visual and textual content at zero marginal cost as frequently as it wants to. That new power gives companies with brandable products tremendous scope for building a brand personality and an engaged following.

Supply-chain disruption provides a fast and effective way to gain traction and steal market share from incumbents. Because it’s fundamentally an innovation around the business model, however, it’s replicable, and thus doesn’t make for a strong moat.

Brand disruption, on the other hand, builds a moat with a loyal fanbase that both reduces customer-acquisition costs through brand evangelism and extends lifetime value by driving the same customers to come back again and again.

"Brand disruption will move front and center. Glossier shows it’s possible to build a seminal D2C brand without innovating on supply chain. A strong community oriented around a brand that lives on multiple online channels — and provides unique IRL experiences — is a deep moat. And there’s plenty of brand innovation still to come — take Volition Beauty, a digitally native beauty brand that crowdsources its product ideas from its community. Whereas Glossier solicited feedback from its customers, Volition is blurring the distinction between producer and consumer even more — or perhaps obliterating it altogether. On a more macro level, channels for brand expression are still emerging: voice and chatbot commerce are promising areas here."

Originally published on December 20, 2018.